Arbitrage Meaning in Stock Market

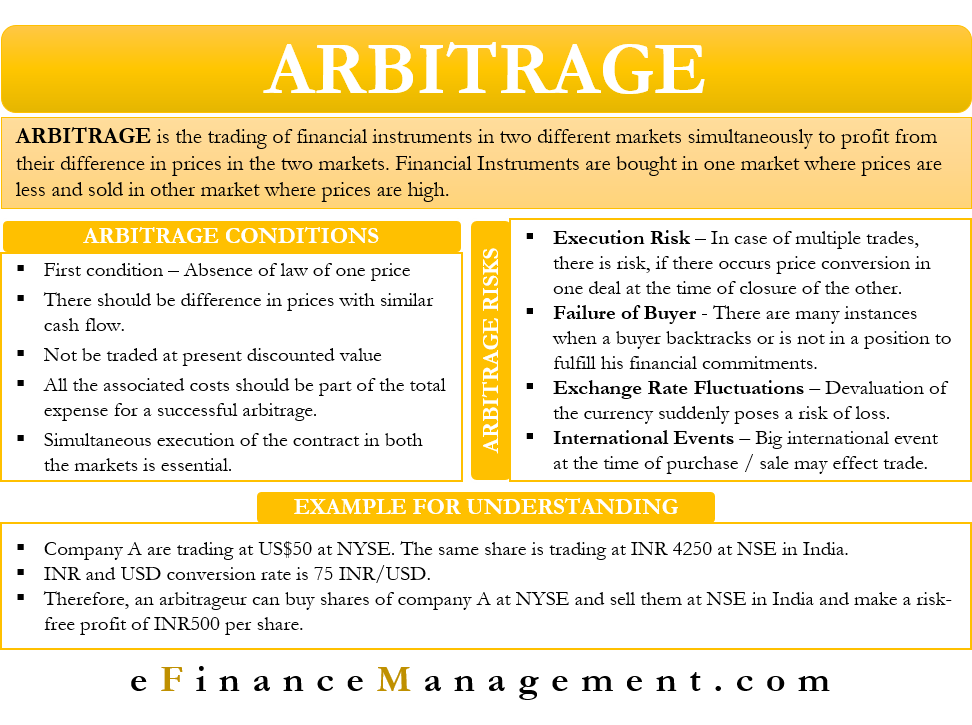

Arbitrage is the exploitation of price discrepancies within different markets of similar or identical assets in order to generate low-risk to no-risk profits after accounting for transaction and. Some traders wait for such opportunities and grab them when they appear.

Arbitrage Definition And Examples A Common Trading Strategy

Free easy returns on millions of items.

. The shares of ABC are trading at 3 on the NYSE while the price on the BSE is Rs 148. In order to do this an arbitrageur buys in the market where the price is lower and at the same time sells in the market where the price is higher. Arbitrage in its purest form is defined as the purchase of securities on one market for immediate resale on another market in order to profit from a price discrepancy.

Read customer reviews find best sellers. Buying the investment and selling it in the future introduces risk to the transaction and is therefore not considered arbitrage. Arbitrage is a technique of making profit on stock exchange trading through difference in prices of two different markets.

Check Out Our Upgraded Website Experience Today. Hence your investment becomes almost risk-free. Arbitrage is basically buying a security in one market and simultaneously selling it in another market at a higher price thereby profiting from the temporary difference in prices of the same security on different exchanges.

The method on the stock exchange of buying something in one place and selling it in another. Ad Browse discover thousands of brands. So Generally Arbitrage trading in.

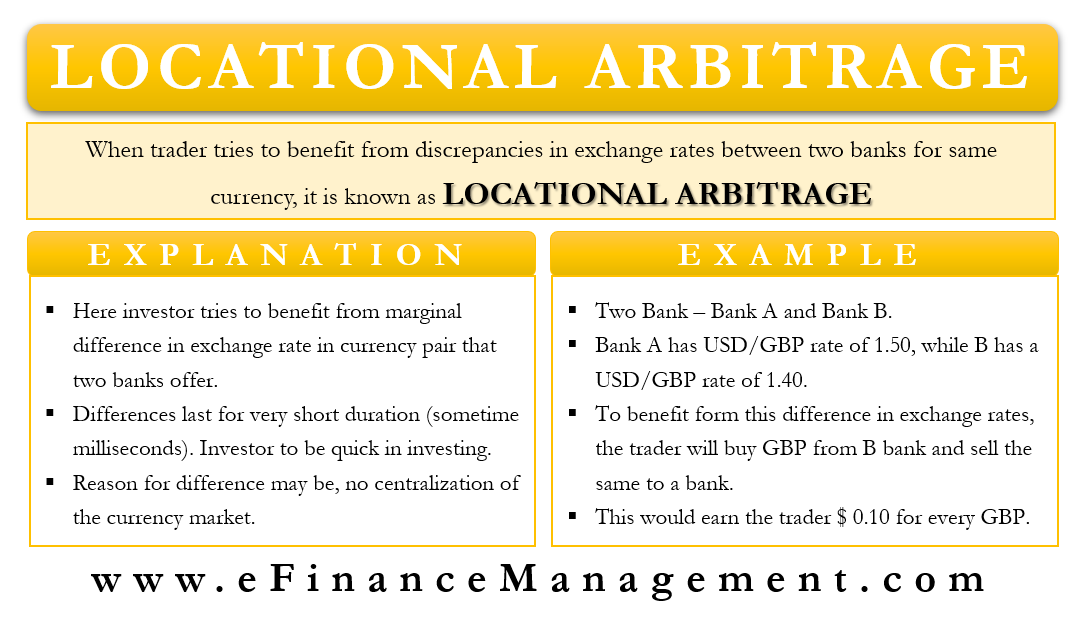

Sometimes arbitrage may also be between one country and another. This is considered a. Arbitrage is a specialized investment technique that involves the simultaneous purchase and sale of a security on different markets to profit from temporary price disparities.

Arbitrage is a financial process that occurs when someone sells the same asset in two different markets simultaneously one at a higher price than the other. There must be at least two comparable assets with differing costs for arbitrage to occur. The definition of Arbitrage is the practice of making money by exploiting price disparities in different markets for the same asset.

The arbitrageur buys in one market and simultaneously sells in another. Arbitrage trading in stock markets is generally possible only in the case of stocks that are listed on multiple exchanges and that operate in different currencies. Ad Nonstop Trading Innovation.

Index arbitrage is a type of arbitrage trading that involves making a profit by locating a difference between the actual price and the predicted price of the stock. In stock market terms arbitrage means you buy a security and sell it somewhere else. Arbitrage is the simultaneous trading of currency commodities securities or other financial instruments in different markets or derivative forms.

Traders can exploit this by buying for the lower price and selling for the higher price. At times due to pricing imbalance the stock market gives us such opportunities. Ad Live Market News Strategy Education On-Demand Videos and More.

It is called foreign arbitrage. Market News Just Got Easier to Navigate. If advantages of price are taken between two markets in the same country it is called domestic arbitrage.

Arbitrage is a trade where a Trader buys the stockshares security in one market and sell the same stock at same time in another market at a higher price to get the profit with zero percentage of Risk Risk free. Arbitrage is a strategy that is used for exploiting the market inefficiencies for making profits. In economics arbitrage is defined as the simultaneous buying and selling of the same securities or other financial instruments to profit from market variations.

Arbitrage allows investors to gain profit in the difference between the two market prices. Free shipping on qualified orders. This results in immediate.

A computer program used to place simultaneous orders for stock or commodities futures and the underlying stocks or commodities usually for large volume. For instance a company ABC is listed on both the BSE and the New York Stock Exchange. Answer 1 of 19.

Arbitrage Trading Program - ATP. Arbitrage is a trading strategy in which there is an attempt to profit from momentary price differences that can develop when a security or commodity trades on two different exchanges. The trader makes a profit by exploiting the inefficiencies in the market.

The aim of arbitrage is to exploit the differing prices for the same asset. An arbitrageur is a type of investor who attempts to profit from price inefficiencies in the market by making simultaneous trades that offset each other to capture risk-free profits. The pay-off investors receive may be large enough to cover the cost of simultaneous transactions.

Locational Arbitrage Meaning Examples And More

What Is Arbitrage Trading Quora

Comments

Post a Comment